48+ what percentage of salary should go to mortgage

Get Instantly Matched With Your Ideal Mortgage Lender. Web By law lenders are prohibited from making mortgages that take up more than 35 percent of your monthly income.

What Percentage Of Your Income To Spend On A Mortgage

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

. Ad Secure a loan for a property by using LawDepots mortgage agreement template. Web Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. Ad Compare the Best Home Loans for March 2023.

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. The highest cohort of homeowners 48 spent 15 or. This handy guide will help you decide exactly how much of your income you can.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web What percentage of your income should go towards your mortgage. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Ad Increasing Mortgage Payments Could Help You Save on Interest. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Ad Get an idea of your estimated payments or loan possibilities.

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or. Web Cadence Bank What Percentage of Income Should Go to Mortgage. John in the above example makes.

Web According to Hometaps 2021 homeowner report homeowners generally seem to be aware of this advice. Get Started Now With Quicken Loans. Apply Get Pre-Approved Today.

Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment. What percentage of income should mortgage be. Web So with 6000 in gross monthly income your maximum amount for.

Ad Compare the Best Home Loans for March 2023. Whats an ideal mortgage-to-income ratio. Web Your front-end ratio is the percentage of your annual gross income that goes toward paying your mortgage and in general it should not exceed 28.

Check Your Official Eligibility. Buying your dream home. Lock Your Rate Today.

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. This rule says that you should not spend more than 28 of. Ad Compare Mortgage Options Get Quotes.

Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Lock Your Rate Today. Try our mortgage calculator.

Rural 1st offers customized Kansas loans with competitive rates. Get Instantly Matched With Your Ideal Mortgage Lender. Web But there are two other models that can be used.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. Get The Service You Deserve With The Mortgage Lender You Trust.

Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Updated FHA Loan Requirements for 2023. Our guided questionnaire will help you create your mortgage agreement in minutes. Apply Get Pre-Approved Today.

For example if your monthly salary is 4000 your. Ad Take the First Step Towards Your Dream Home See If You Qualify. And you should make.

Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly. Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no. Get Your Estimate Today.

Income To Mortgage Ratio What Should Yours Be Moneyunder30

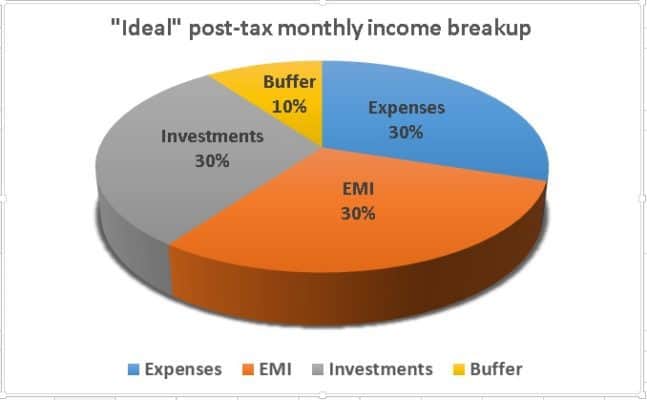

What Percentage Of Monthly Income Should My Home Loan Emi Be

How Much House Can You Buy For 1 000 Per Month The Homa Files

What Percentage Of Income Should Go To My Mortgage Mares Mortgage

What Percentage Of Your Income Should Go To Mortgage Chase

How Much Of Your Income Should Be Spent On A Mortgage Budgeting Money The Nest

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Income Should Go To Mortgage Banks Com

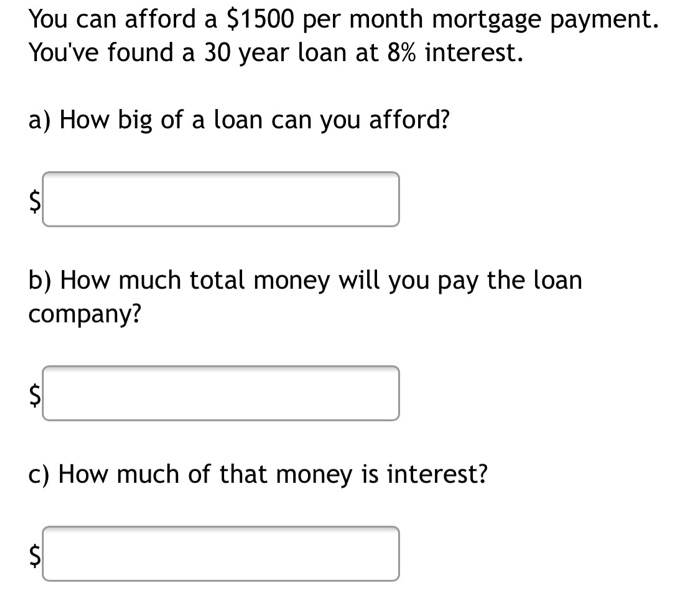

Solved You Can Afford A 1500 Per Month Mortgage Payment Chegg Com

How Much House Can You Afford Readynest

How Much House Can I Afford Insider Tips And Home Affordability Calculator

What Are Operating Expenses And How Do You Recognise It Quora

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

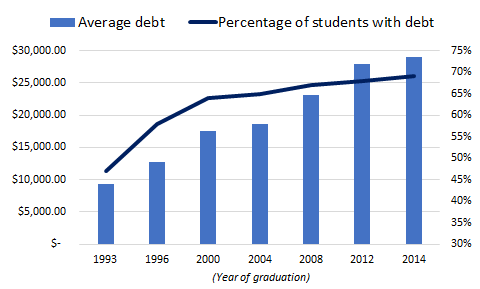

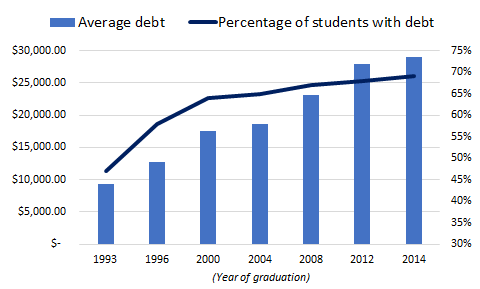

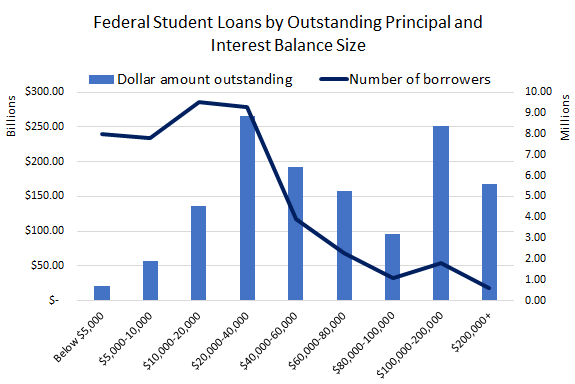

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

What Percentage Of Income Should Go To Mortgage

Solved First Filling The Blank A Back End B Front End Chegg Com